Jon Swinn

This article covers the history of the initial development of diplomatic relations between Israel and China highlighting the key players and their history.

Shira Efron, Howard J. Shatz, Arthur Chan, Emily Haskel,Lyle J. Morris, Andrew Scobell

The RAND Corporation have finally addressed the evolving Israel-China relationship. This extensive study details the many aspects of the relationship. The study contains information that is vital in understanding the background and direction of this geopolitical partnership in the development of China's geopolitical strategic control of trade and ports via the Belt and Road Initiative.

Shira Efron, Emily Haskel and Karen Schwindt

Relations between China and Israel have expanded rapidly since the early 2000s in numerous areas, including diplomacy, trade, investment, construction, educational partnerships, scientific cooperation, and tourism. Israel seeks to expand its diplomatic, economic, and strategic ties with the world's fastest-growing major economy and diversify its export markets and investments. China seeks Israel's advanced technology and values Israel's location as part of the Belt and Road Initiative. Chinese investments in Israel have grown substantially and include investments in high-tech companies that produce sensitive technologies as well as the construction and operation of key infrastructure projects. Chinese investment in sensitive technologies and construction of major Israeli infrastructure projects present distinct concerns for Israel and the United States. The authors examine the extent and nature of Chinese investments in Israeli technology and infrastructure and discuss the security implications these pose for Israel and the United States. The primary concern regarding investment relates to Chinese ownership of companies that might possess sensitive technology or data; concerns over construction are focused on the use of infrastructure projects to further Chinese foreign policy goals. The operation of infrastructure projects affords China unique surveillance opportunities and possibly economic and political levers of influence. The report concludes with a set of open-ended questions that merit further investigation to better understand the magnitude of risks associated with Chinese investment in the Israeli market.

This is the text area for this paragraph. To change it, simply click here and start typing.Once you've added your content, you can customize the design using different colors, fonts, font sizes and bullets. Highlight the words you want to design and choose from the various options in the text editing bar.

In July 2018, the management of the first part of the new port in Haifa was transferred to the Shanghai International Port Group (SIPG). Despite U.S. President Donald Trump’s ferocious anti-China stance, Israel still decided to give SIPG a 25-year strategic perch in our region.

Amarelle Wenkert

Yunnan Province governmental holding group YIG and Israeli IT company Aman Group will jointly develop a blockchain infrastructure for the Chinese market, focusing on maritime shipping and health applications

Sam Chester

Will increased tech and trade cooperation with China upset Israel’s critical alliance with the U.S.?

Rami Blachman

China is determined to embrace Israel’s thriving tech hub of “Silicon Wadi,” concentrated mostly in the greater Tel Aviv region, and known for its abundance of deep tech startups and close ties to Silicon Valley.

Noa Landau

Relations between Israel and China are warming up, with Jerusalem believing the U.S. is unlikely to take issue if exports of advanced military tech is kept out of the picture

Tovah Lazaroff

"China is Israel’s second largest trade partner reaching $10 billion in 2017 and it is already up 30% in 2018." Netanyahu said.

Dale Aluf

The recent appointment of Wang Qishan as China’s head of the China-Israel Joint Committee on Innovation Cooperation sends a clear indication: Israel is very important to China.

Dave Gordon

In 2016 China's direct investment in Israel almost tripled to $16bn (£12bn), according to a report in the South China Morning Post newspaper.

Meanwhile, the Jerusalem Post predicts that China will overtake the US as the number one source of overseas investment in Israel.

Yossi Melman

Benjamin Netanyahu ignored the intelligence operations of Beijing and Moscow for too long. Now, the Israeli government is finally paying attention, but it could be too late.

A recent survey by the Israeli intelligence community that is not in the public domain shows that Chinese investment in the Middle East rose by 1,700 percent between 2012 and 2017. Altogether, the Chinese have invested $700 billion in the region. Nearly half of it is in the energy sector, $150 billion in research and development, $113 billion in industry, $103 billion in transportation, $68 billion in the military field, $4 billion in financial loans, and only $155 million in humanitarian aid.

note- Yossi Melman is an Israeli intelligence asset operating as a journalist. In this article the Israeli state's complicity and role in these turn of events are purposely downplayed.

Toi Staff

“Chinese influence in Israel is particularly dangerous in terms of strategic infrastructure and investments in larger companies,” Argaman said at a closed-door speech at Tel Aviv University.

Argaman noted that Chinese companies would be taking over operating part of the Haifa port and constructing the Tel Aviv light rail system, and were actively seeking to acquire other major Israeli firms..

Prime Minister Benjamin Netanyahu and Chinese Vice President Wang Qishan, today (Wednesday, 24 October 2018), at the Foreign Ministry in Jerusalem, chaired the fourth meeting of the Israel-China Joint Committee on Innovation Cooperation.

The government of The People’s Republic of China (PRC) and the government of the State of Israel signed a bilateral agreement in 2010 to form the China-Israel Cooperation Program for Industrial R&D with the primary aim of supporting joint industrial R&D projects aimed at the development of products or processes leading to commercialization in the global market. The bilateral framework is jointly implemented by the Chinese Ministry of Science and Technology (MOST) on behalf of the Chinese Government and the Israel Innovation Authority.

Yaakov Katz & Amir Bohbot

This was “arms diplomacy” at its best, with Israel using superior technology and military expertise to get a country to become its ally. It is a model the country would continue to refine and use successfully—well after the secret arms trip in 1979.

Chinese ecommerce giant Alibaba has announced that it is opening an R&D lab in Israel. Speaking at Alibaba's Computing Conference in China, CTO Jeff Zhang unveiled a $15 billion global research program, which includes opening seven R&D labs worldwide over the next three years in Tel Aviv, Beijing, Hangzhou, San Mateo, Bellevue, Moscow, and Singapore. Zhang said that Alibaba is initially seeking to recruit 100 talented researchers from around the world.

This is the text area for this paragraph. To change it, simply click here and start typing.Once you've added your content, you can customize the design using different colors, fonts, font sizes and bullets. Highlight the words you want to design and choose from the various options in the text editing bar.

Charlotte McEleny

Alibaba has become the latest to invest in artificial intelligence ecommerce startup Twiggle, adding to its recent spate of headline-grabbing investments.

Twiggle is an AI platform that uses data and natural language systems to make search “more intuitive” and better adapted to some of the newer search forms, such as voice, mobile and conversational methods.

The Chinese ecommerce giant will likely be wanting to be close to startups like Twiggle as artificial intelligence starts to become a key part of web-based services like search and social, and filters into its heartland of online shopping.

Jon Russell

Alibaba announced a massive $15 billion research ‘DAMO Academy’ project focused on R&D last month, and it is laying the groundwork for an office in Tel Aviv through a deal to acquire technology and talent from Israeli startup Visualead.

Catherine Shu

Infinity Augmented Reality, an Israeli startup, has been acquired by Alibaba, the companies announced this weekend. The deal’s terms were not disclosed. Alibaba and InfinityAR have had a strategic partnership since 2016, when Alibaba Group led InfinityAR’s Series C. Since then, the two have collaborated on augmented reality, computer vision and artificial intelligence projects.

Rebecca Fannin

Alibaba Group has inked another strategic deal in high tech Israel, in its China to Israel outreach, leading a Series B investment of $26.4 million in Israeli database analytics developer SQream in Tel Aviv.

Vivian Foo

Chinese multinational networking and telecommunications equipment manufacturer Huawei has reportedly completed the acquisition of Israeli database security and compliance solution startup HexaTier for US$42 million.

On the other hand, HexaTier is available on Amazon Web Services (AWS) and Google Cloud Platform. Its technology is also compatible with Microsoft Azure SQL Database.

Note - The HexaTier service may be a connection point for database access, within the customer's segmented virtual environment.

Paul Sawers

Chinese technology giant Huawei has reportedly snapped up Toga Networks, an Israel-based company that provides “advanced technology research and high level design for the IT and Telecom markets,”

Huawei and Toga Networks have long been known to be in collaboration, though the exact nature of the partnership hasn’t been entirely clear. Some reports from earlier this year suggested that Toga could actually be a Huawei subsidiary, however both companies poured cold water on that notion.

Gab Perez

Chinese telecommunications equipment giant Huawei has announced a return to full activity in Israel, and a restructuring of its service, marketing and sales network here. The company says it has chosen Bug, Ronlight Digital and KSP as exclusive importers, and that it is in advanced talks with the mobile carriers. Huawei will probably sell to the carriers directly, while sales on the open market will be via the designated importers.

China’s dominant search engine Baidu Inc has made its first venture into Israel’s booming start-up sector, investing $3 million in video capture firm Pixellot.

Pixellot developed a system of unmanned cameras that it says can cover the entire field or court at a sporting event and automate video production for both professional broadcasters and amateur fans.

Peter Fang, senior director of corporate development at Baidu, said on Sunday the Israeli technology “will revolutionise video content production” for internet users in China.

Meir Orbach

This is the text area for this paragraph. To change it, simply click here and start typing.Once you've added your content, you can customize the design using different colors, fonts, font sizes and bullets. Highlight the words you want to design and choose from the various options in the text editing bar.

David Shamah

Taboola is best-known for its “you may also be interested in” meme, which is ever-present on innumerable web content pages. The system is used to drive traffic from one site to another, or to keep readers on a site by offering them more of what they came for. Using advanced intelligence techniques based on hundreds of metrics – how long a reader stays on a site, how many times they visit one, which ads they linger on when viewing a site (e.g., how quickly they close pop-up windows), where they are located, and more – Taboola determines what content will be most interesting to a reader, and presents links that, site owners hope, will garner more clicks for a site or a network.

David Shamah

Chinese Internet giant Baidu, along with its Israeli venture capital partner Carmel Ventures, on Tuesday announced that it was investing $5 million in Israeli start-up Tonara, which makes interactive apps to help prospective musicians learn how to play.

Israel's Mobileye has expanded its presence in the auto industry through tie-ups with Asian companies such as China's Baidu thanks to its strength in visual processors, a key field in the intensifying race to perfect driverless technology.

The tie-ups are in line with Mobileye's strategy to build autonomous cars by 2021.

Mobileye, which was bought by U.S. chipmaker Intel last year for $15 billion, announced a strategic relationship with Chinese internet group Baidu last month. As part of its driverless car development, Baidu will introduce Mobileye's artificial intelligence-powered EyeQ chip to process visual information around the car captured by cameras. The technology will then be sold to Chinese automakers.

Asaf Shalev

Baidu, the Chinese tech conglomerate, is using the data it collects on users of its search, social and navigation services to create an internal credit score for each user, according to Wilson Zhu, a senior manager in Baidu’s asset management department.

Israel's Bank Leumi and Ping An, China's largest insurance group, signed a strategic cooperation agreement earlier this week to promote the entry and integration of Israeli high-tech companies into the Chinese market. The agreement was signed as part of Israeli Prime Minister Netanyahu's visit to China, marking the 25th anniversary of diplomatic relations between the two countries.

CIVC-China-Israel Value Capital is a China-focused Private Equity Fund, investing in high growth Chinese companies with ten to over a hundred million dollars in revenues. CIVC increases the companies' value by enhancing product lines with Market proven Israeli technologies.

Founded in 1993, Infinity Group is dedicated to unlocking the full value of cross border partnerships. It does so by creating innovative platforms based on creative business models, investment funds and incubation eco systems that harmoniously link people, technologies and markets. Infinity Group is well-known for its strong roots in China, its vast, global network of technology, IP and innovation, its unrivalled know-how and expertise.

Meir Orbach and Uri Pasovsky

To map Chinese tech investments in Israeli tech firms Calcalist interviewed over a dozen venture capital executives, and reviewed data collected by Israel-based market research firm IVC Research Center Ltd. and Tel Aviv-based non-profit organization Start-Up Nation Central (SNC).

The result: a list of Chinese limited partners of local venture funds, which have proven to be a central channel for Israel-bound capital coming from China. Entries include a list of Chinese limited partners, the identity of the local venture fund, some of its partners, and some of its portfolio companies.

Abigail Klein Leichman

Shamir and Catalyst partners Edouard Cukierman, Alain Dobkin, Boaz Harel, Dorothee Moshevich and Olga Bermantare focusing onmature companies with proven game-changing products and a global presence in sectors such as manufacturing, agriculture, healthcare, water, energy, technology, media and telecommunication.

Kerry Bolton

The Zionist state’s relationship with China is something that has come to public attention with a new Chinese documentary on Israel, although the relationship between Communist China and Israel is of long and strategic duration.

Walk into Israel – the Land of Milk and Honey has been produced by China’s national TV channels in co-operation with Israel state authorities. The title should be a giveaway as to the nature of the series: one of the sustaining myths of Israel is that the superior Jewish settlers made Palestine flourish where once it was just sand occupied by a pack of rag-heads; never mind that Palestine was, before being blessed by the presence of Irgun, Haganah, Palmach and Stern, a land of plenty

Amanda Walgrove

Dr. Pan Guang, Director of the Shanghai Cooperation Organization Studies Center and Dean of the Center of Jewish Studies Shanghai, has developed a recent project, Jews in China: Legends, History, and New Perspectives, which outlines the history of Jewish and Chinese relations, beginning with the four waves of Jewish immigration to China. As early as the eighth century, Jews from the Middle East traveled over the Silk Road to Kaifeng and formed a Kaifeng Jewish Community during the Song Dynasty.

Martin R. Gordon

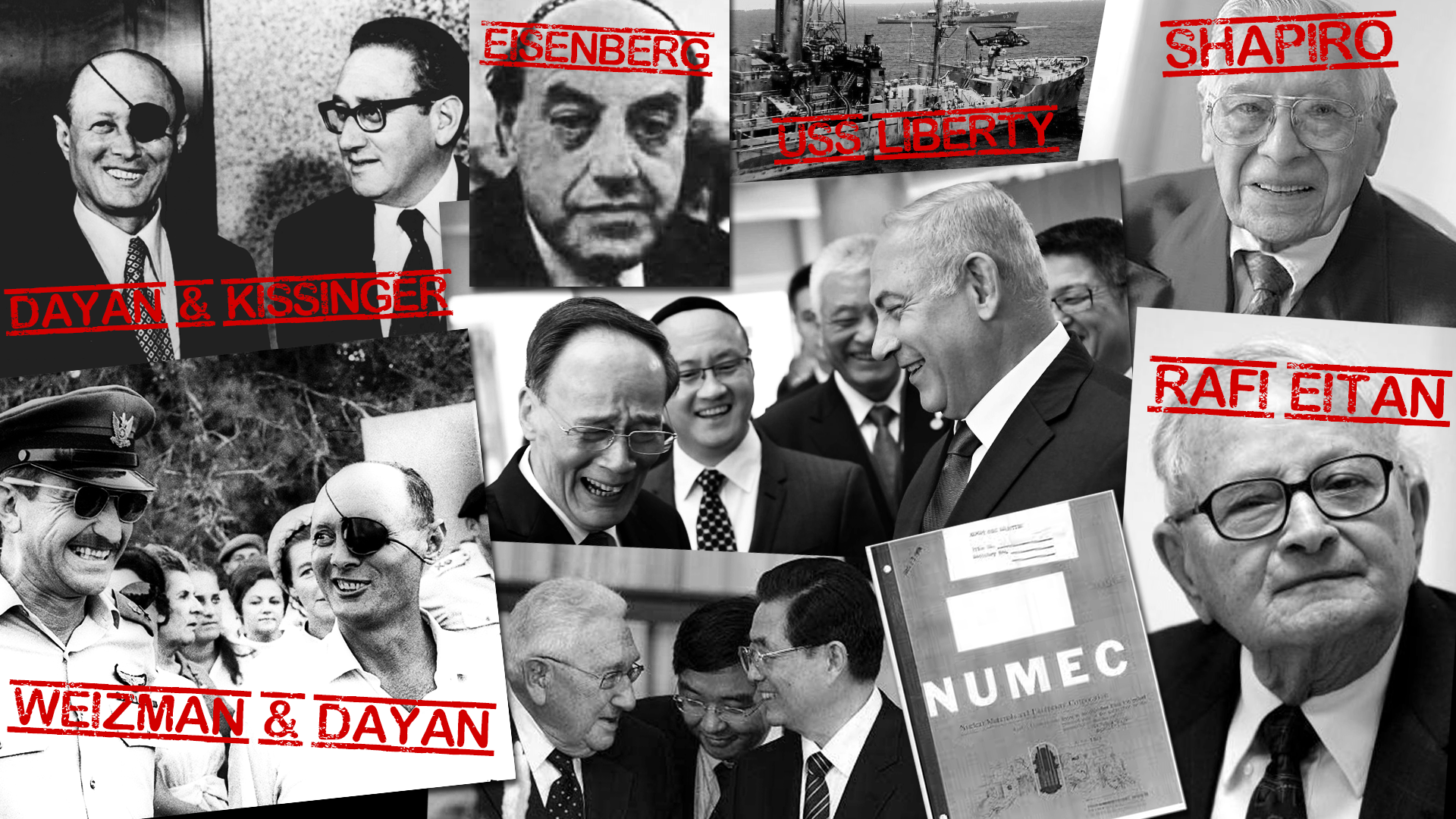

Israel has sold advanced military technology to China for more than a decade and is moving to expand its cooperation with Beijing, says R. James Woolsey, the Director of Central Intelligence.

The C.I.A. assessment was provided in written responses to questions by the Senate Governmental Affairs Committee. The committee made the assessment public last week as part of a report on recent hearings it conducted on "proliferation threats of the 1990's," a committee aide said tonight.

There have been many news reports about the sale of Israeli military technology to China, which did not establish diplomatic relations with Israel until 1992, and the Rand Corporation has made similar assessments. The C.I.A.'s response to the committee was reported tonight by NBC News and confirmed by the aide.

Yaacov Benmeleh

"Israel is going east," Nafatli Bennett, the country's economy minister, said at the conference on May 22. "We are shifting our economic resources to Bangalore, Africa and China, China, China."

That shift is also taking place in the country's academic circles. Tel Aviv University announced last week that it's teaming up with Tsinghua University in Beijing to establish the XIN Center for research into areas like nanotechnology.

Ilanit Hayut

The Chinese government's Bright Food Group signed an agreement this morning to buy control of Israel's largest food company, Tnuva Food Industries Ltd. from Apax Partners. The sale is being made at a company value of NIS 8.6 billion which will bring a profit of NIS 4 billion to Apax (56% stake) on which it will not be required to pay any tax.

Tova Dvorin

A top Israeli defense official was forced to step down last week, according to Maariv Sunday, after the United States expressed fury at Israel's decision to sell military equipment to China.

Meir Shalit, the Department Head for Defense Exports at the Defense Ministry, announced his resignation last week. While Shalit did not announce the reasons behind his resignation, the report claims that he voluntary resigned after US official investigations last month over the transfer revealed that the move took place with his approval. Shalit apologized to the US in a visit late last week.

Patrick Cockburn

ISRAEL has sold at least dollars 2bn ( pounds 1.3bn) to dollars 3bn of hi-tech military equipment to China, seriously undermining US efforts to limit the sale of advanced weapons to the Chinese. A Senate report due out later this week says the Israeli exports include military technology developed by the US, and which Washington expressly forbids from being exported to China.

Officials accompanying Israel's Prime Minister, Yitzhak Rabin, on a visit to China confirmed that Israel had done deals but would not elaborate. The CIA told the committee the Chinese were seeking from Israel technologies that Western firms were unwilling to provide.

Those sold by Israel are said by specialists to include technology for the Python - the Israeli version of the US Sparrow air-to-air missile - and technology developed for the US-financed Lavi jet, which the Israelis cancelled some years ago.

Meir Orbach

Avi Hasson, the former chief scientist at the Israeli Ministry of Economy, is raising a $100 million fund backed by Chinese investors, in partnership with former colleague and founder of Emerge Fund Dovi Ollech. The two announced the new fund, called Emerge II, in a press conference in Beijing on Friday, alongside several of the fund's largest Chinese investors.

Isaac Stone Fish

The Chinese perception of Jews as expert moneymakers does not have the religion-based antagonism that often accompanies the same stereotype elsewhere in the world, and probably had its start in the mid-19th century, when investors began flocking to China. Many of the first foreign real-estate tycoons, such as Silas Hardoon and the scions of the Sassoon family, were Jewish. Michael Kadoorie—who hails from a wealthy Jewish family that dates its China connection back to 19th-century Shanghai, and who’s made his fortune in power generators and hotels—currently ranks as the richest non-Chinese in greater China, with an estimated net worth of $5 billion.

Max Schindler

re than 100 Israeli start-up founders and entrepreneurs wined and dined with hundreds of Chinese investors at the GoForIsrael Conference in the Chinese city of Foshan last week.

The large turnout is a sign of burgeoning east Asian interest in the “Start-Up Nation” – with 70 translators helping to grease the wheels between the two sides.

“More than 800 one-on-one meetings were held between Chinese investors and Israeli companies, which continued well after the conference ended,” said Haggai Ravid, CEO of Cukierman & Co. Investment House. “All the Israeli companies have received a great deal of interest.”

The Israeli companies pitching themselves specialize in fields such as artificial intelligence, the “Internet of Things,” life sciences, cybersecurity and autonomous driving technologies.

Tim Kennedy

Israel's Lavi fighter-bomber was designed to be one of the deadliest weapons in the air. However, it now has been revealed that after Israel discontinued the largely U.S.-funded project, it sold China the plans for the Lavi and the associated secret U.S. technology. This has enabled the Chinese to build their own version of this new generation of fighter aircraft.

The illegal transfer of plans for the Lavi aircraft from Tel Aviv to Beijing first became known by the Pentagon when an American surveillance satellite orbiting over China spotted several new fighter planes on the runway of a Chinese air base traditionally used for the test and evaluation of prototype aircraft. Imagery experts at the U.S. Central Intelligence Agency (CIA) created rough sketches of the jet, then processed the graphic data through high-speed supercomputers in order to obtain three-dimensional representations of the prototype Chinese fighter planes.

Idan Rabi

A new venture capital fund originating in China will invest $100 million in Israel, sources inform "Globes." The new fund is called MizMaa Ventures - a combination of the Hebrew words for east and west. The fund began operating a year ago, and has operated under the radar up until now. All of the money it raised is designated for investment in local startups.

MizMaa has obtained funding from three wealthy Chinese families, with most of the money coming from the Chen family, believed to be the 58th wealthiest family in the world. In the next stage, MizMaa will try to raise $150 million for another fund.

Joe King

Morris “Two-Gun” Cohen was the one and only Jewish Chinese General and,

for a time, was head of the Chinese Secret Service! One of his colleagues was

Dr. Moses Schwarzberg, a Russian Jew who helped save China, for a time,

from the Communists.

The official languages (in order of importance) in the Chinese Secret Service,

during the time of the Two Moishes, were Chinese, Yiddish and English.

Asaf Shalev

The new office launches as Chinese companies increasingly look to Israel for tech innovation and as China’s One Belt One Road Initiative opens up new investment opportunities

Jonathan Margolis

There is a not inconsiderable history among the children of successful, prominent Jewish families of getting involved in leftwing politics. From the Marxes to the Milibands, it’s a well-trodden path. Few have taken this tradition quite as far, however, as Sidney Rittenberg, scion of a prominent Jewish family in Charleston, South Carolina.

It was in the 1930s that Rittenberg rejected a career as a lawyer and became a trade union and civil rights activist. He then went a little further. He became a communist, learnt Chinese, went to China, joined Mao Zedong’s guerrillas fighting Chiang Kai-shek’s nationalists, emerged after the communist victory as a senior party member close to Mao, ran Radio Peking, translated Mao’s thoughts into English, became a leading rabble rouser in the Cultural Revolution – and, by the by, was imprisoned for 16 years in solitary confinement, accused of being a US spy. Then he came back to the US and made a fortune advising American companies on how to get into China

Michael O. Billington and Joseph Brewda

The open "secret" of Israeli military support to the communist dictatorship in mainland China has now been effectively acknowledged. Amidst much fanfare in the press, an Israeli trade delegation headed by the chairman of the board of

Israeli Military Industries (IMI) , Gen. Dan Shomron (who is also the former chief of staff of the Israeli Defense Forces), visited Beijing for 11 days at the end of November. It was

simultaneously announced that Israeli Defense Minister Moshe Arens had secretly visited Beijing Nov. 4-8. Both governments are reporting that official relations are expected to be established in a matter of months.

This public diplomacy comes at a time when the Bush administration has been publicly exerting pressure on the President's "old friends" in Beijing over several issues, including trade, demands for joint action against China's ally North Korea, and, in particular, demands that China cease missile sales to the Muslim world.

Since it is well known that Israeli arms sales are largely "pass-along" technology from the United States, and since the Israeli ties to the People's Republic of China are known to be fully supported by Washington, the timing of the Israeli move serves to notify Beijing that the British and American support for the bloody regime will continue, despite the Bush administration's public clamor against them.

Yossi Melman

A report ties Lev Leviev with Chinese intel, which is busy making crucial acquisitions in Africa, South America and the U.S

Gary K Busch

The recent article in Ha’aretz newspaper by Yossi Melman (U.S. ties Israeli billionaire with Chinese intelligence}, points out the continuing relationship of Israeli business with China; and with Chinese intelligence in particular. This relationship of China with Jewish businessmen is not a new phenomenon.

Clarissa Sebag-Montefiore

“Do the Jews Really Control America?” asked one Chinese newsweekly headline in 2009. The factoids doled out in such articles and in books about Jews in China—for example: “The world’s wealth is in Americans’ pockets; Americans are in Jews’ pockets”

The Rothschild family businesses can trace their first contact with China to the 1830's. Our business was one of the first Western business institutions to re-establish relations after 1953.

Global Advisory provides impartial, expert advisory and execution services to large and mid-sized corporations, private equity, families and entrepreneurs. We have direct access to the Chinese and North Asian markets through our local Chinese bankers who are based on the ground in Shanghai, Beijing, and Hong Kong, and supported by a partnership in South Korea.

We command an in-depth knowledge of the region's economic development and the challenges facing its industries, and have developed an exceptional understanding of the local regulatory and market environment. Our team is skilled at bridging the cultural gaps that can exist between the managements of foreign and local companies, and are the leading adviser to Chinese companies investing in Europe.

Wealth and Asset Management in Hong Kong provides Wealth Management services to help clients structure and safeguard their wealth, and to invest and manage their financial assets. We serve successful families, entrepreneurs, foundations and charities.

Adler was born in Britain and became a U.S. citizen in 1936, when he obtained employment in the United States Department of the Treasury. Adler also was a Soviet spy who supplied information to the Silvermaster espionage ring.

Adler served in China and shared a house with Chi Ch’ao ting and "China hand" John Service. From China, Adler sent back reports opposing President Franklin Roosevelt's gold loan program of $200 million to help the Nationalist Chinese Government stabilize its currency in 1943. Secretary Harry Dexter White and Frank Coe supported this view (to de-stabilize the anti-Communist government of Chiang Kai-Shek). Hyperinflation in China amounted to more than 1000% per year between 1943 and 1945, weakening the standing of the Nationalist government domestically in China. This helped the Communists eventually to come to power in China, delivering hundreds of millions of people into their hands.

Mr. Eisenberg was head of the Israel Corporation, which is one of the largest holding companies in Israel and which has interests here and in Europe and Asia.

He had controlling interests in the Israel Chemicals conglomerate and in Zim Navigation, Israel's biggest shipping company.

''Shoul Eisenberg was a most unusual figure in the international business world,'' said a former Finance Minister, Avraham Shohat. ''For decades he was active in places where Western businessmen never went,'' Mr. Shohat told Israel's Army Radio.

Wayne Madsen

"One of the key players in the Israel-South African nuclear weapons research was Israeli arms smuggler Shaul Eisenberg, the head of the Israel Corporation and a provider of military hardware to China, North Korea, and the Khmer Rouge in Cambodia. Eisenberg, whose Wikipedia entry has been re-written by Israeli propagandists, controlled Israel Aircraft Industries and Zim Israel Navigation Shipping Company. Eisenberg was able to provide needed nuclear weapons components from Operation Phoenix to China and two of its major allies, North Korea and Pakistan."

M.K. Styllinski

(Eisenberg's) financial enabler and fellow agent was banker Tibor Rosenbaum, head of the Geneva based Banque du Credit international (BCI) [4] which during the late fifties and sixties was actively involved in laundering money from the criminal empire of Meyer Lansky. Like Rosenbaum, Lansky was a fierce Zionist. His financial contributions to the 'cause' ensured his protection from the MOSSAD. Tibor Rosenbaum funded and supported Eisenberg giving the tycoon enormous financial leverage and covert influence over global business politics. [5] The corporations and companies owned by Eisenberg and now under his son Erwin's control include: Iron Mt Recordkeeping, Iron Mtn mining, Rotron, Wackenhut, Israel Chemicals, Eisenberg Industries of Israel, Permindex, Legacy foundation of Nevada, Eisenberg Satellite and Telecom."

Christopher Bollyn

"Nissim is not just an older partner with the Harel brothers, he is one of the key players in the 9/11 false-flag terrorism with other members of the Betar (Zionist militia) from China. Shaul Eisenberg, Mossad's mega-agent in China and Japan, was also involved with the Betar brigades in China in the 1930s and 40s. Eisenberg is the smoking gun between these Betar Likudniks from China and 9/11. Eisenberg owned Atwell, a Mossad company that tried to get the security contract for the Port Authority of New York and New Jersey (World Trade Center, airports, harbors, tunnels, etc.) in 1987."

Richard I. Cohen

This is the text area for this paragraph. To change it, simply click here and start typing.Once you've added your content, you can customize the design using different colors, fonts, font sizes and bullets. Highlight the words you want to design and choose from the various options in the text editing bar.

Sassoon, in collaboration with Parsi merchants of Bombay, expanded his trade in opium and textiles in China and opened a branch in Shanghai. He made enormous profits with which he started an oil mill in Bombay. He later became a leading industrialist, owning a large number of mills in the Bombay area. His foray into textiles and fabrics saw his profits moving further upward. Slowly and steadily he reached the dizzying heights of success in business. Through his efforts Sassoon Docks at Colaba in the city of Bombay were built.

Sarah Lazarus

Hong Kong has for more than 150 years been home to a diverse Jewish population, many members of which have played a pivotal role in making the city what it is today.

Luke Ford

According to the 1906 Jewish Encyclopedia entry on David Sassoon: “his business, which included a monopoly of the opium-trade, extended as far as Yokohama, Nagasaki, and other cities in Japan. Sassoon attributed his great success to the employment of his sons as his agents and to his strict observance of the law of tithe.”

The article offers a brief history of the B'nai B'rith Shanghai Lodge in Shanghai, China. It relates that on May 6, 1928, Standard Oil executive I. Covitt, business writer George Sokolsky, and others opened the B'nai B'rith Shanghai Lodge #1102. It says that the accomplishments of the lodge in periods before the World War II include the creation of Jewish schools, financing of scholarships, and founding of an employment bureau.

John Gee

CHINA HAS unveiled an aircraft that some observers suggest bears a suspicious resemblance to the Lavi, a jet that Israel developed in the 1980s and then decided not to produce. China says that the J-10 was designed and produced by the Chengdu Aircraft Industry Corporation. It entered service with the People’s Liberation Army Air Force (PLAAF) in 2004 and its existence was officially confirmed when the PLAAF issued photographs of the aircraft on Dec. 29, 2006. The official Chinese news agency, Xinhua, later distributed them.

Ben Brimelow

The plans for the fighter were then said to have been sold to China. Some US government officials even believed that Israel and China were collaborating with each other to develop the fighter.

Brian Schrauger

Geographically, Israel is just off-center. Why then is it treated with such respect, especially by the likes of Russia and China?

Rebecca Fannin

Anyone doubting the impact of the Tech Triangle as a new world order in technology leadership should have been at the Technion World Tour 2017 in New York City. At a four-day program highlighting science and technology innovations, the tech trio markets of Israel, China and New York were highlighted.

Technion president Peretz Lavie led a day-long visit to the newly opened Cornell Tech, home to Jacobs Technion-Cornell Institute, on Roosevelt Island. Here, three major facilities have popped up so far on a 12-acre campus: the Bloomberg Center academic hub, The Bridge startup and research center, and the environmentally advanced, student residential high-rise..

Adam Abrams

GTIIT “will serve as a reminder to China of Israel’s unique assets such as excellence in advanced education and the ability to innovate,” said Carice Witte, executive director of Sino-Israel Global Network and Academic Leadership, an institute working to advance Israel-China relations.

“Depending on how the university evolves, it could also provide an ongoing platform for Chinese to become acquainted with Israelis and for Israelis to learn how things are done in China,” she said.

Shiri Moshe

The Technion — Israel Institute of Technology became the first Israeli university to inaugurate a campus in China on Monday.

The Guangdong Technion Israel Institute of Technology (GTIIT) is a result of a 2013 partnership between the leading Israeli school and Shantou University in China’s southern Guangdong province.

The campus — the first the Haifa-based Technion has opened outside of Israel — is “the brainchild” of leading Hong Kong investor and philanthropist Li Ka-shing, American Technion Society spokesperson Kevin Hattori told The Algemeiner.

The project was funded with a $130 million grant from the Li Ka Shing Foundation — the biggest sum ever gifted to the Technion — and some $147 million of Chinese government funding.

Christina Lin

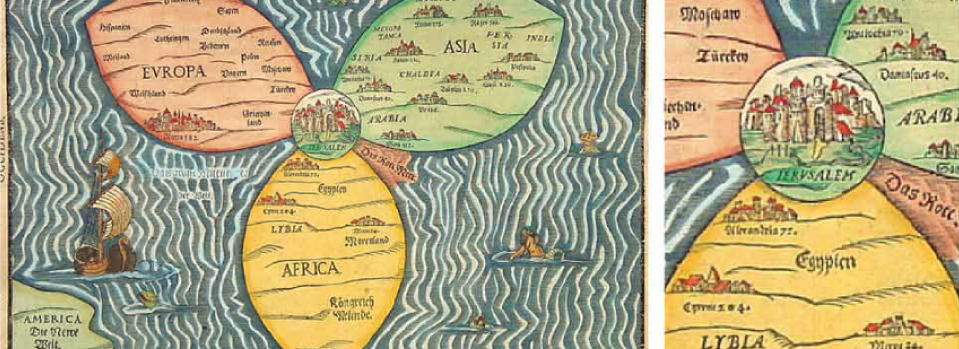

ossef Bodansky, an Israeli-American political scientist and senior editor of GIS/Defense & Foreign Affairs Daily, wrote an insightful article in their September issue regarding the convergence of China’s Afro-Eurasian integration project and Bunting’s map of the world as a clover leaf.

srael as key node on China’s New Silk Road

With the rise of Salafi-jihadism in the Middle East increasingly threatening China’s overseas citizens and assets, especially to their maritime trade via the Suez Canal, Israel is emerging as a strategic node on China’s southern corridor on the New Silk Road.

China’s infrastructural footprint in Israel began with the Carmel Tunnels near Haifa in 2007, six years before BRI’s formal announcement. Yet, it is the projected “Med-Red” railway linking Eilat with Ashdod, reportedly to be constructed by China, that could transform Israel into a land bridge along the Maritime Silk Road.15 If handled well, this might even very modestly offset the disparity in the volume of Chinese infrastructural projects elsewhere in the Middle East and Africa compared to Israel. While any land bridge would be secondary to the Suez Canal in importance and shipping volume barring political instability in Egypt, the “Red-Med” could still offer a more cost-effective alternative route, ideally enmeshing Israel and China with Egyptian cooperation

The first China Cultural Center in West Asia opened in Israel's central city of Tel Aviv on Sunday, aiming to spread the Chinese culture and facilitate exchange and cooperation between the two countries.

The center, also the 35th of its kind worldwide, sits in Tel Aviv's business district and covers a total area of about 1,000 square meters, with facilities such as a multi-purpose hall, training rooms, a library and an audio-visual area.

It is designed to host events such as art performances, cultural exhibitions, academic seminars and other activities to allow the Israelis a better understanding of the Chinese culture.

China's Vice Culture Minister Zhang Xu said at the opening ceremony that the relationship between the two peoples determines the direction of the ties between two countries.

The new Israel-China accelerator program in Beijing is led by Israel's Ministry of Economy and Industry in cooperation with China's Shengjing Group and DayDayUp.

Marco De Novellis

MBA students from China Europe International Business School (CEIBS) have just returned from a week-long innovation tour of Israel, as Chinese firms ramp up investment in ‘startup nation’

China is seeking more sectors to cooperate with Israel in high technology under the background of the "innovative comprehensive partnership" established between China and Israel.

This is the common sense reached among officials, entrepreneurs and experts from China and Israel, who attended the 6th China-Israel Hi-tech Investment Summit held Sunday in Haifa, northern coastal city of Israel.

China-Israel hi-tech cooperation has been further expanded from sectors such as agriculture, medicine and biology to leading-edge sectors such as life science, smart city, aging tech, robotics and 3D printing, according to them.

Diamond Mines, Caprice, Ahava cosmetics and others are among the first businesses in the Middle East to offer instore payments with Alipay’s digital wallet.

Mark O'Neill

That was the astonishing prediction made by the Jerusalem Post in December. In 2016, Chinese investment in the Jewish state reached a record US$16.5 billion, according to Thomson Reuters.

Driving this are Chinese companies eager to invest in high-technology and Internet startups, of which Israel is one of the world centers. Historically, it has been American and European capital that invested in them and took them public. In Europe, 101 Israeli firms have launched IPOs and, in the United States, 272.

Rebecca Fannin

Deal making between China and Israel was debated by a panel of top venture capitalists at the recent Silicon Dragon event in Tel Aviv. Certainly, it seems the pros currently outweigh the cons. But this could be short term.

Gwen Ackerman and Li Hui

At one of the largest tech conferences in Israel’s history, about 10,000 investors roamed start-up booths, learned how artificial intelligence can help treat neuro-disorders and visited a doctor’s office of the future.

The venue was a February summit hosted by OurCrowd, the Jerusalem-based crowdfunding investment platform. Almost one in five visitors hailed from Asia, where China spends more than $100 billion a year on prescription medicines.

S. Solomon

The municipal government of Guangzhou, formerly known as Canton, the most populous city in the province of Guangdong in southern China, is seeking to create a startup ecosystem for companies in very early stages of development and is partnering with a former chief scientist of Israel to help recreate the startup nation’s success locally.

The local authorities are seeking to turn the city into a tech powerhouse and a knowledge-based economy with international influence by 2020, and are stepping up efforts to boost innovation in a variety of sectors, including information technology (IT), biotechnology, new materials and energy.

Shannon Tiezzi

That diplomatic approach was given a name during Netanyahu’s visit, which saw the two sides agree to elevate their relationship to an “innovative comprehensive partnership.” Innovation is the key word: it refers to cooperation on technological breakthroughs, something China is keen to do. According to Xinhua, a joint statement released by the two countries pegs a number of fields for increased cooperation, including “air pollution control, waste management, environmental monitoring, water conservation and purification, as well as hi-tech fields.” China and Israel also plan to establish “a global technology transfer center, innovation parks and an innovative cooperation center,” Xinhua reported.

Subtitle

This is the text area for this paragraph. To change it, simply click here and start typing.Once you've added your content, you can customize the design using different colors, fonts, font sizes and bullets. Highlight the words you want to design and choose from the various options in the text editing bar.

Hong Kong tycoon Li Ka-shing’s venture-capital fund, Horizons Ventures Ltd., may only be a bit player in Silicon Valley, but its making a much bigger mark in Israel: the fund is the biggest source of foreign cash for growing numbers of startups in Tel Aviv, according to IVC Research Center, which tracks the market.

Horizons, backed by the wealth of Asia’s richest man, was the first major Asian investor to invest in Israeli tech entrepreneurs in 2011 when Horizons led a $30-million fundraising round in Waze.

Over the last five years, Horizon Ventures, Li’s venture capital arm, has put money into many of Israel’s most innovative companies, a total of more than 24 investments